NEWS

Sappi reports results for the third financial quarter

Commenting on the group’s results, Sappi Chief Executive Officer, Steve Binnie said: “The group faced a particularly challenging quarter, marked by ongoing global economic weakness and heightened uncertainty stemming from persistent trade and tariff tensions. Sales volumes were impacted by the ramp-up of the Somerset Mill PM2 project. As a consequence the group delivered Adjusted EBITDA of US$80 million.”

The macroeconomic pressures weighed heavily on selling prices across many of our product categories, with dissolving wood pulp (DWP) in particular experiencing significant downward pricing pressure. Operationally, the Somerset Mill PM2 conversion and expansion project was completed in early May 2025 and impacted EBITDA for the quarter by approximately US$22 million due to the extended shut on the machine prior to this date. Subsequently, start-up volumes were at low levels, in line with the planned ramp-up projections, further impacting quarterly sales volumes. The forestry fair value price adjustment for the quarter was a loss of US$9 million.

A key milestone for this quarter was the successful start-up of the Somerset Mill PM2 line in North America in May. Although the start-up occurred later than originally planned, ramp-up progress and customer qualification trials were encouraging, with excellent initial market feedback on product quality. The conversion of Somerset Mill PM2 from 235,000 tpa of coated woodfree paper to 470,000 tpa of paperboard marks a significant step in advancing Sappi’s strategy to reduce reliance on declining graphic paper markets and drive growth in the packaging and speciality paper segments. This investment enhances the region’s product offering and reinforces the long-term competitiveness of Sappi’s North American operations.

Looking forward to Sappi’s fourth quarter, Binnie stated: “Taking into account current trading conditions, the ongoing trade tariff uncertainty and volatility in global markets, the ramp-up of Somerset Mill PM2 and the anticipated operational efficiency improvements, we estimate that Adjusted EBITDA for the fourth quarter of FY2025 will be above that of the third quarter.”

Financial summary for the quarter

- Adjusted EBITDA US$80 million (Q3 FY24 US$148 million)

- Loss for the period US$33 million (Q3 FY24 profit of US$51 million)

- Net debt US$1,947 million (Q3 FY24 US$1,340 million)

- Adjusted EPS excluding special items 4 US cents loss (Q3 FY24 9 US cents profit)

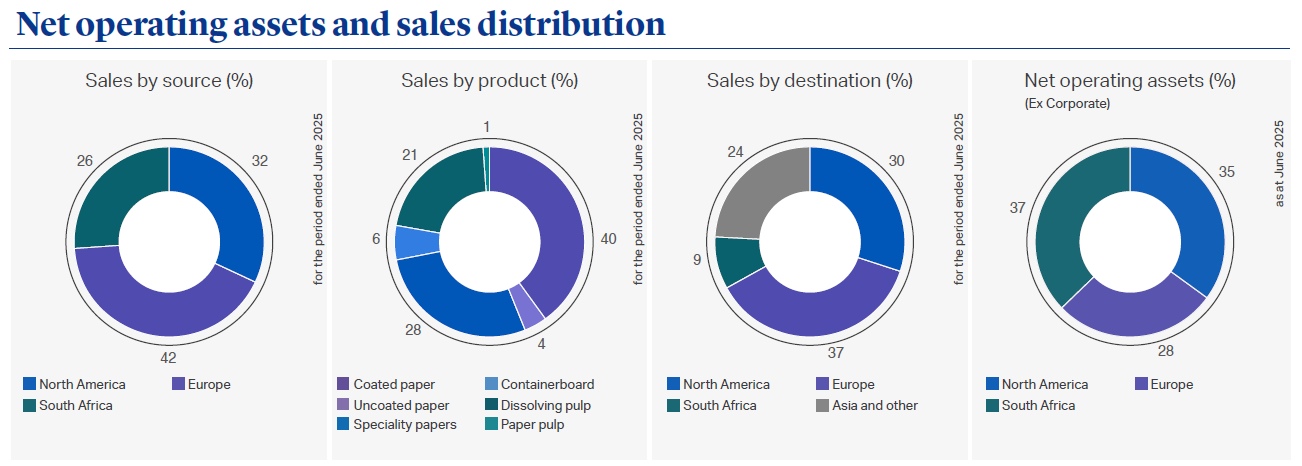

Dissolving wood pulp (DWP) markets faced challenging conditions during the quarter. While demand is typically seasonally weaker during the third quarter, sentiment across the textile value chain was further dampened by uncertainty surrounding potential US tariff threats. In addition, China’s deflationary environment and low paper pulp prices encouraged swing mill producers to increase DWP production. This contributed to a supply-demand imbalance and a short-term oversupply of DWP in the market. Consequently, the Chinese hardwood DWP market price1, fell US$100/ton to end the quarter at US$800/ton. Despite the headwinds, demand for Sappi’s DWP remained stable. Sales volumes for the pulp segment were 4% below the prior year due primarily to reduced external sales of high yield pulp from the Matane Mill as we increased internal integration into our North American packaging papers business. Additionally, a scheduled maintenance shutdown at the Cloquet Mill, absent in the prior year, contributed to higher costs.

Demand across global packaging and speciality papers markets remained muted, weighed down by lingering economic challenges and cautious consumer behaviour. Competitive pressures in Europe intensified, largely due to oversupply across all product categories. In South Africa, while local containerboard demand strengthened with the onset of the citrus season, sales were constrained by low inventory levels following extended downtime at the Ngodwana Mill in the previous quarter. While segmental sales volumes and pricing were stable year-on-year, profitability was negatively impacted by substantially higher costs, primarily associated with the start-up of Somerset Mill PM2. Selling prices in North America were negatively impacted by softer market conditions and a shift in product mix ahead of the Somerset Mill ramp-up. As a result, the segment’s profitability was significantly lower than the equivalent period last year.

The graphic papers segment continues to navigate long-term structural decline, with global oversupply amplifying pricing and competitive pressures. Ongoing uncertainty around potential US tariffs added to the challenges, disrupting supply chains and creating further headwinds. Despite these dynamics, Sappi sales volumes outperformed broader market contraction, reflecting strategic efforts to defend and grow market share. In North America, the delayed start-up of Somerset Mill PM2 created operational disruptions and resulted in reduced production and higher costs for the graphic papers asset at the site.

The European region continued to face challenging market conditions, driven by persistent macroeconomic weakness and oversupply in paper markets. Ongoing uncertainty around potential US tariffs caused disruptions to supply chains, with increased import volumes of Asian graphic papers intensifying competitive pressures. Sales volumes and pricing declined year-on-year, with cost-saving initiatives only partially mitigating the impact. Consequently, the profitability of the region was significantly reduced compared to the prior year. In response to the ongoing weakness and overcapacity in the packaging and speciality papers markets, Sappi Europe announced in July 2025 a consultation process regarding the proposed closure of certain assets with a capacity of 90,000 tpa at its Alfeld Mill in Germany, aimed at aligning capacity with demand and improving cost competitiveness of the mill.

The North American region’s performance in the quarter was impacted by the extended Somerset Mill PM2 machine shut and subsequent start-up and commissioning activities, as well as the planned 18-month maintenance shutdown at the Cloquet Mill which reduced earnings by US$22 million and US$16 million respectively. These operational factors reduced efficiencies and constrained production, resulting in higher costs and lower sales volumes compared to the prior year. As a result, profitability for the region declined year-on-year.

Profitability in the South African region improved compared to the previous quarter but remained below the prior year’s level, mainly due to lower regional sales volumes, increased variable costs, and a sharp decline in DWP selling prices. The forestry fair value price adjustment for the quarter was a loss of ZAR179 million. Despite the high levels of market uncertainty, demand for Sappi’s DWP remained steady with sales volumes comparable to the previous year. However, ZAR-denominated selling prices were 5% lower than the prior year, which in combination with increased costs, led to margin compression for the segment. Containerboard demand was strong, underpinned by positive domestic market sentiment with citrus export forecasts projecting a 9% increase over last year. Sales volumes were restricted by low inventory levels stemming from the extended maintenance shutdown at Ngodwana Mill in the previous quarter.

Adjusted earnings per share for the quarter was a loss of 4 US cents, below the profit of 9 US cents in the prior year and reflective of the challenging operating conditions in the quarter. Special items reduced earnings by US$2 million. Net debt of US$1,947 million was US$277 million above last quarter. This was due to net cash utilised for the quarter of US$136 million and a negative currency translation effect of US$114 million due to a substantially weaker US Dollar on our Euro denominated debt. The net cash utilised for the quarter was due to the weak operating performance, a working capital outflow of US$22 million and a capital expenditure of US$129 million, which included scheduled maintenance shuts and expenditure associated with the Somerset Mill PM2 conversion and expansion project.

Although the major expansion at Somerset Mill is now behind us, the peak in net debt associated with this expansionary capex cycle is occurring at a time of volatile and weak macroeconomic conditions. This does not change our strategy to target an absolute net debt level of less than US$1 billion.

Outlook

Escalating tariff-related trade tensions between the United States and key global trading partners continue to contribute to significant uncertainty in the international economic landscape. We are closely monitoring these developments and their potential adverse effects on trade flows and consumer demand across our core markets. While these conditions may negatively affect our financial performance, we remain focused on maintaining agility and strong cost discipline to navigate any resulting challenges.

The textile and apparel sector, which is a key driver of DWP demand, remains highly sensitive to ongoing trade tensions and inflationary pressures. Weak textile fibre prices, including VSF, and low paper pulp pricing have intensified pressures on DWP. However, the outlook for global DWP demand remains positive and the current Chinese hardwood DWP market price is below the industry marginal cost. Therefore, we are cautiously optimistic that prices will recover in the year ahead particularly as the Chinese market price has recently risen to US$810 per ton. Despite short-term volatility, our DWP business remains well positioned to benefit from long-term structural demand growth.

The fourth quarter outlook for the packaging and speciality papers segment is centred on the commercial ramp-up of the Somerset Mill PM2 project. As expected during this phase, near term profitability will be negatively impacted while we improve operational efficiencies and increase capacity utilisation. Strategically, we aim to optimise our product portfolio mix and position the North American business to capture long-term growth opportunities as market conditions improve. Demand for containerboard in South Africa remains healthy, while in Europe our focus is on managing capacity utilisation, strengthening our competitive cost position, and completing the Alfeld Mill consultation process.

Demand for graphic papers continues to decline, in line with the structural trend. Our strategic focus remains on proactively managing capacity utilisation and driving cash generation from our assets. Efforts to grow market share are delivering positive results, with year-on-year gains reinforcing our competitive position in this challenging environment.

Trade tensions and overcapacity in global paper pulp markets are exerting downward pressure on prices, which is expected to benefit our paper businesses in Europe and North America, where we are not fully integrated. Furthermore, with no maintenance shutdowns planned for the fourth quarter, we anticipate improved operational efficiencies across our mills. We further anticipate that the forestry fair value price adjustment will be positive.

Within the context of our elevated net debt levels and ongoing macroeconomic uncertainty, Sappi remains firmly focused on preserving liquidity and strengthening cash flow. We have implemented a broad range of cost-saving initiatives across our operations and continue to apply disciplined capital allocation. Non-essential capital expenditure has been deferred where possible, resulting in a reduction of our FY2025 capex forecast from US$550 million, as estimated in the second quarter, to US$510 million. This marks the completion of our strategic investment cycle and capex for FY2026 and FY2027 will be substantially lower. In addition, the board has determined that there will be no dividend declared for FY2025. Reducing net debt is our immediate priority and we will continue to assess our capital allocation in line with our financial position and long-term strategic objectives.

1 Market price for imported hardwood dissolving wood pulp into China issued daily by the CCF Group.